Bernard Madoff’s $50 billion hedge fund scam is being called “the biggest Ponzi scheme in history.” Over the past ten years, Madoff scammed individual investors, hedge funds, and charities out of billions of dollars, embezzling money that was supposed to have been invested. When the stock market tanked in late 2008 and Madoff’s victims tried to withdraw their money, his fund had less than $7 billion left. A media firestorm has since erupted around the disgraced businessman. The sheer enormity of his fraud has rocked the financial world and shocked the nation.

According to the Securities and Exchange Commission (SEC), a Ponzi scheme is a form of fraud in which “money from new investors is used to pay off earlier investors until the whole scheme collapses.” Usually, investors are ensnared by promises of inordinately high returns. At first, as more and more victims pour cash into the scheme, the “fund” seems stable. Those few who wish to withdraw their money may do so. On paper, everyone seems to be doing very well. But their gains are illusory. Eventually, when more people try to withdraw their returns, they find that the money is not there; the fraudster has embezzled and spent it.

According to the Securities and Exchange Commission (SEC), a Ponzi scheme is a form of fraud in which “money from new investors is used to pay off earlier investors until the whole scheme collapses.” Usually, investors are ensnared by promises of inordinately high returns. At first, as more and more victims pour cash into the scheme, the “fund” seems stable. Those few who wish to withdraw their money may do so. On paper, everyone seems to be doing very well. But their gains are illusory. Eventually, when more people try to withdraw their returns, they find that the money is not there; the fraudster has embezzled and spent it.

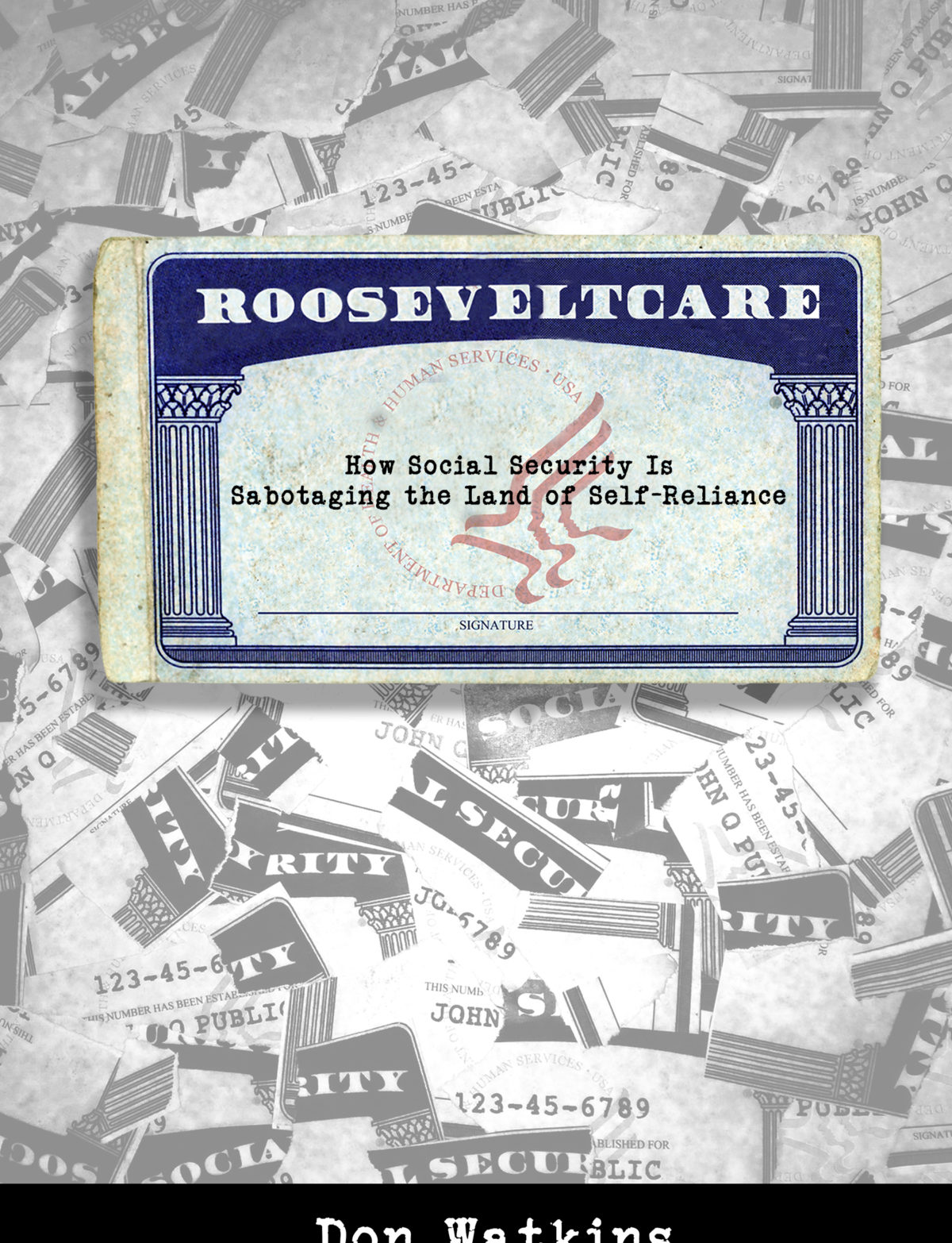

But there is a much greater Ponzi scheme at work in the U.S., one which has duped millions of people out of trillions of dollars for over 50 years. The title of “biggest Ponzi Scheme in history” rightfully belongs to Social Security.

Social Security was set up as a Ponzi scheme from the beginning. Money taken from new “investors” was used to pay off earlier “investors,” or to pay off those who never invested money at all. The money taken from one’s paycheck each month is not saved for his retirement but is immediately spent on other retirees. Any excess cash left in the Social Security fund is spent by the federal government on other programs. As with other Ponzi schemes, at first this structure appeared stable. The Baby Boomer generation was much larger than the preceding generation, so there was plenty of money to go around. But now, as the Boomers are beginning to retire, the consequences of this massive fraud are becoming apparent.

As the SEC explains, inevitably the “whole [Ponzi] scheme collapses.” It must collapse, necessarily, because fraud on such a grand scale is unsustainable over a long period of time. Already, payouts to retirees greatly exceed the amount “invested” by the employed. According to a 2008 report by the Social Security Board of Trustees, over the next 75 years the Social Security Trust Fund will be $4.3 trillion in the red. The government has delayed the inevitable collapse of the program by raising the retirement age and continually raising the Social Security tax rate. On the face of it, the Madoff scandal and Social Security seem completely different. One involves an individual defrauding others to enhance his own wealth, while the other is a social service program perpetrated by federal government. But morally, they involve the same violation–fraud is fraud. It doesn’t matter whether it’s a crook trying to pilfer money from unwary investors, or a government promising retirement income it cannot deliver.

The real difference between Bernie Madoff and the federal government is that Madoff is subject to prosecution for his fraud, while the U.S. government can and does commit its theft with impunity. Madoff is a criminal, and deserves the enmity he has received. If only the public objected to Social Security with the same outrage.